UPSC Prelims 2021 Analysis

Subject-Wise MCQ Distribution

- Environment & Ecology (18 questions): Consistently a major component due to its relevance in both the Civil Services Examination (CSE) and the Indian Forest Service (IFoS) prelims. Several questions required maps for identifying key environmental regions.

- Indian Polity (18 questions): A high-weightage subject with several assertion-based and conceptual questions.

- Economy (14 questions): Covered major economic policies, fiscal measures, and budget-related aspects.

- Science & Technology (13 questions): Focused on innovations, emerging technologies, and applications in real-world scenarios.

- History (24 questions total):

- Ancient History: 3 questions

- Medieval History: 4 questions

- Modern History: 7 questions

- Art & Culture: 10 questions, including match the following-based formats.

- Geography (9 questions total):

- Indian Geography: 5 questions

- Physical Geography: 2 questions

- World Geography: 2 questions

- Social Issues & Schemes (2 questions): Covered important government initiatives and their societal impact.

- International Relations (2 questions): Focused on international organizations and global events, underlining the importance of reading newspapers and NCERT basics.

Difficulty Analysis

- Easy (35 questions): Required fundamental NCERT knowledge and factual recall.

- Medium (38 questions): Needed deeper analytical abilities and elimination techniques.

- Hard (27 questions): Demanded conceptual clarity, particularly in assertion-reasoning and interdisciplinary topics.

Variations in Question Framing

- Multi-Statement Based Questions: A large portion of the paper tested analytical abilities by requiring candidates to determine the correctness of multiple statements.

- Direct Questions: Some questions were fact-based, relying on static knowledge from textbooks and previous UPSC question papers.

- Application-Based Questions: Many questions in Economy and Science & Technology assessed real-world applications of concepts.

- Match the Following: Commonly seen in Art & Culture, Geography, and Environment sections.

Static vs Current Affairs Distribution

- Static Content: Dominated the paper with key subjects like History, Polity, Geography, and Economy forming the foundation.

- Current Affairs (22 questions): Focused on recent government policies, budget highlights, and global events influencing India.

Key Learnings for Future Preparation

- Master Static & Current Affairs: A blend of both is necessary, especially for high-weightage subjects like Polity, Economy, and Environment.

- Strengthen Analytical Abilities: Many questions required assertion-reasoning, elimination techniques, and multi-statement evaluation.

- Focus on Budget & Economic Policies: Economy and budget-related topics remain crucial for UPSC preparation.

- Practice Match the Following & Statement-Based MCQs: These were heavily featured in Geography, History, and Environment sections.

- Utilize Maps for Geography & Environment: Many UPSC last year question papers have included map-based questions, making this an essential skill.

Subject-Wise Answer Key

QUESTION 1

Easy

Economy

Prelims 2021

Consider the following statements:

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government.

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

- The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

QUESTION 2

Medium

Economy

Prelims 2021

With reference to India, consider the following statements:

- Retail investors through demat account can invest in ‘Treasury Bills’ and ‘Government of India Debt Bonds’ in primary market.

- The ‘Negotiated Dealing System-Order Matching’ is a government securities trading platform of the Reserve Bank of India.

- The ‘Central Depository Services Ltd.’ is jointly promoted by the Reserve Bank of India and the Bombay Stock Exchange.

Which of the statements given below is/are correct?

A. 1 Only

B. 1 and 2

C. 3 Only

D. 2 and 3

QUESTION 3

Easy

Economy

Prelims 2021

Which among the following steps is most likely to be taken at the time of an economic recession?

A. Cut in tax rates accompanied by increase in interest rate.

B. Increase in expenditure on public projects.

C. Increase in tax rates accompanied by reduction of interest rate.

D. Reduction of expenditure on public projects.

QUESTION 4

Easy

Economy

Prelims 2021

Which one of the following effects of creation of black money in India has been the main cause of worry to the Government of India?

A. Diversion of resources to the purchase of real estate and investment in luxury housing.

B. Investment in unproductive activities and purchase of precious stones, jewellery, gold, etc.

C. Large donations to political parties and growth of regionalism.

D. Loss of revenue to the State Exchequer due to tax evasion.

QUESTION 5

Easy

Economy

Prelims 2021

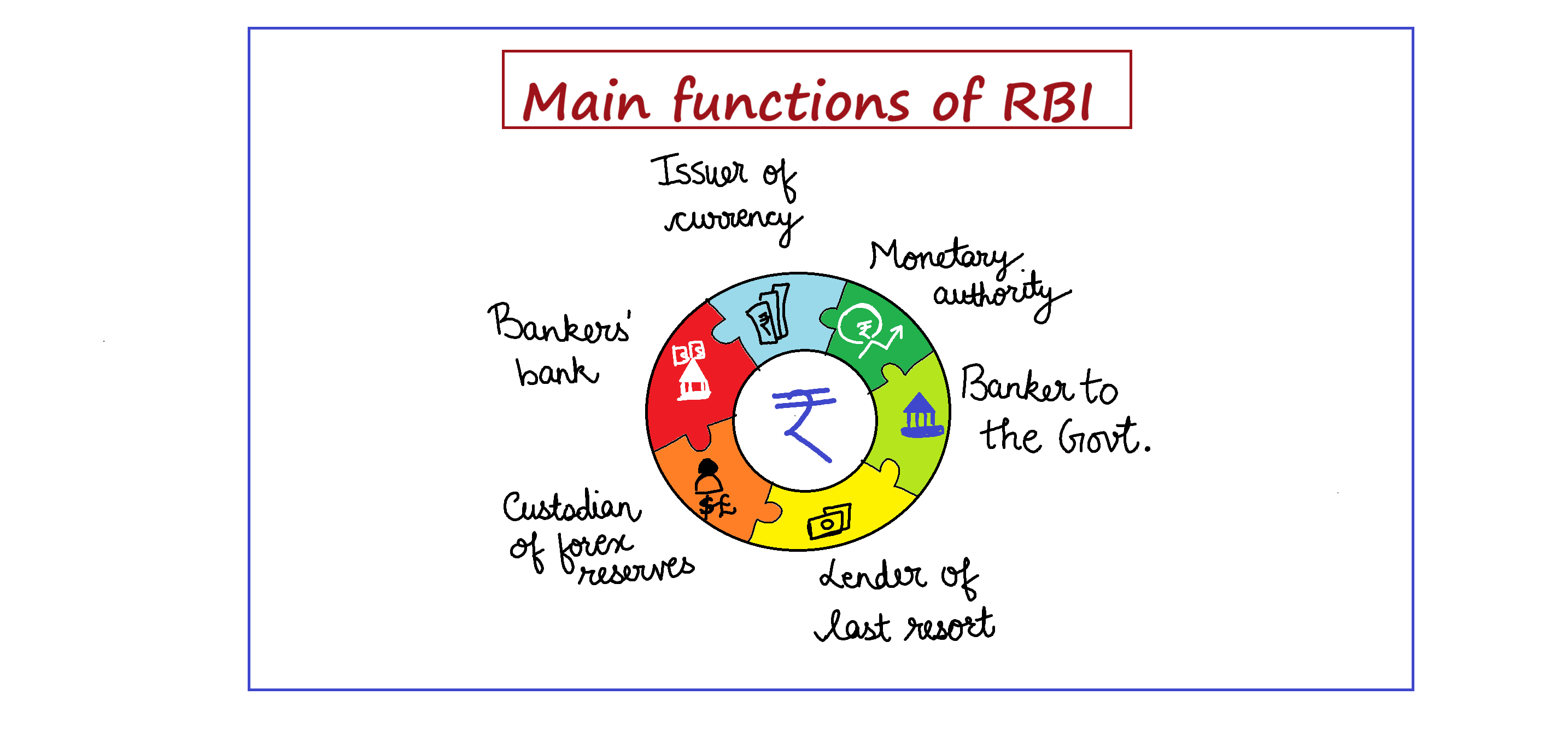

In India, the central bank’s function as the ‘lender of last resort’ usually refers to which of the following?

- Lending to trade and industry bodies when they fail to borrow from other sources.

- Providing liquidity to the banks having a temporary crisis.

- Lending to governments to finance budgetary deficits.

Select the correct answer using the code given below:

A. 1 and 2

B. 2 Only

C. 2 and 3

D. 3 Only

QUESTION 6

Easy

Economy

Prelims 2021

Consider the following statements: Other things remaining unchanged, market demand for a good might increase if

- Price of its substitute increases

- Price of its complement increases

- The good is an inferior good and income of the consumers increases

- Its price falls

Which of the statements given above is/are correct?

A. 1 and 4 only

B. 2, 3 and 4

C. 1, 2 and 3

D. 1, 2, 3 and 4

QUESTION 7

Easy

Economy

Prelims 2021

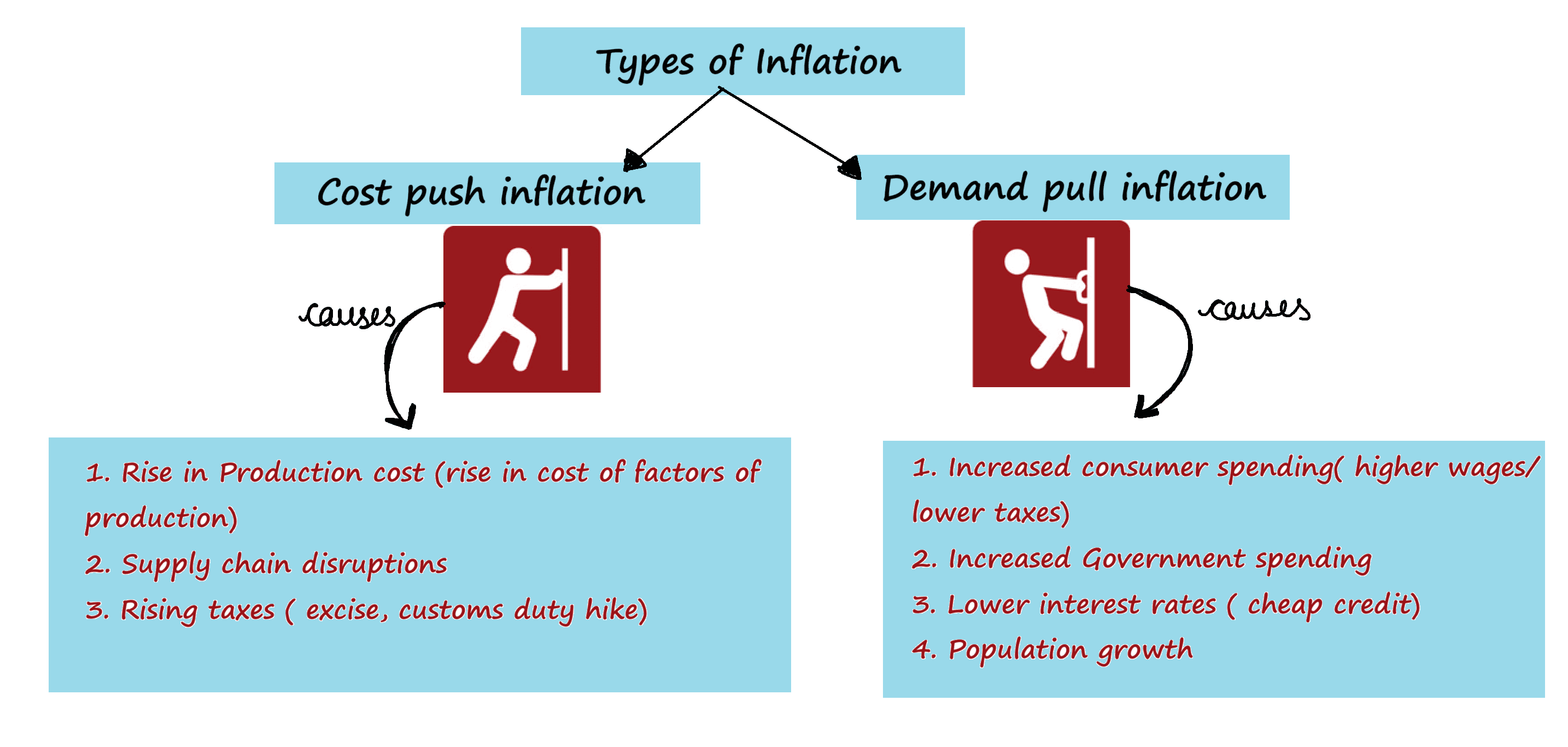

With reference to Indian economy, demand pull-inflation can be caused/increased by which of the following?

- Expansionary policies

- Fiscal stimulus

- Inflation-indexing wages

- Higher - purchasing power

- Rising interest rates

Select the correct answer using the codes given below.

A. 1, 2 and 4 Only

B. 3, 4 and 5 Only

C. 1, 2, 3 and 5 Only

D. 1, 2, 3, 4 and 5

QUESTION 8

Medium

Economy

Prelims 2021

With reference to ’palm oil’, consider the following statements:

- The palm oil tree is native to Southeast Asia.

- The palm oil is a raw material for some industries producing lipstick and perfumes.

- The palm oil can be used to produce biodiesel.

Which of the statements given above are correct?

A. 1 and 2 Only

B. 2 and 3 Only

C. 1 and 3 Only

D. 1, 2 and 3

QUESTION 9

Easy

Economy

Prelims 2021

Consider the following statements: The effect of devaluation of a currency is that it necessarily:-

- improves the competitiveness of the domestic exports in the foreign markets.

- increases the foreign value of domestic currency.

- improves the trade balance.

Which of the above statements is/are correct?

A. 1 Only

B. 1 and 2

C. 3 Only

D. 2 and 3

QUESTION 10

Medium

Economy

Prelims 2021

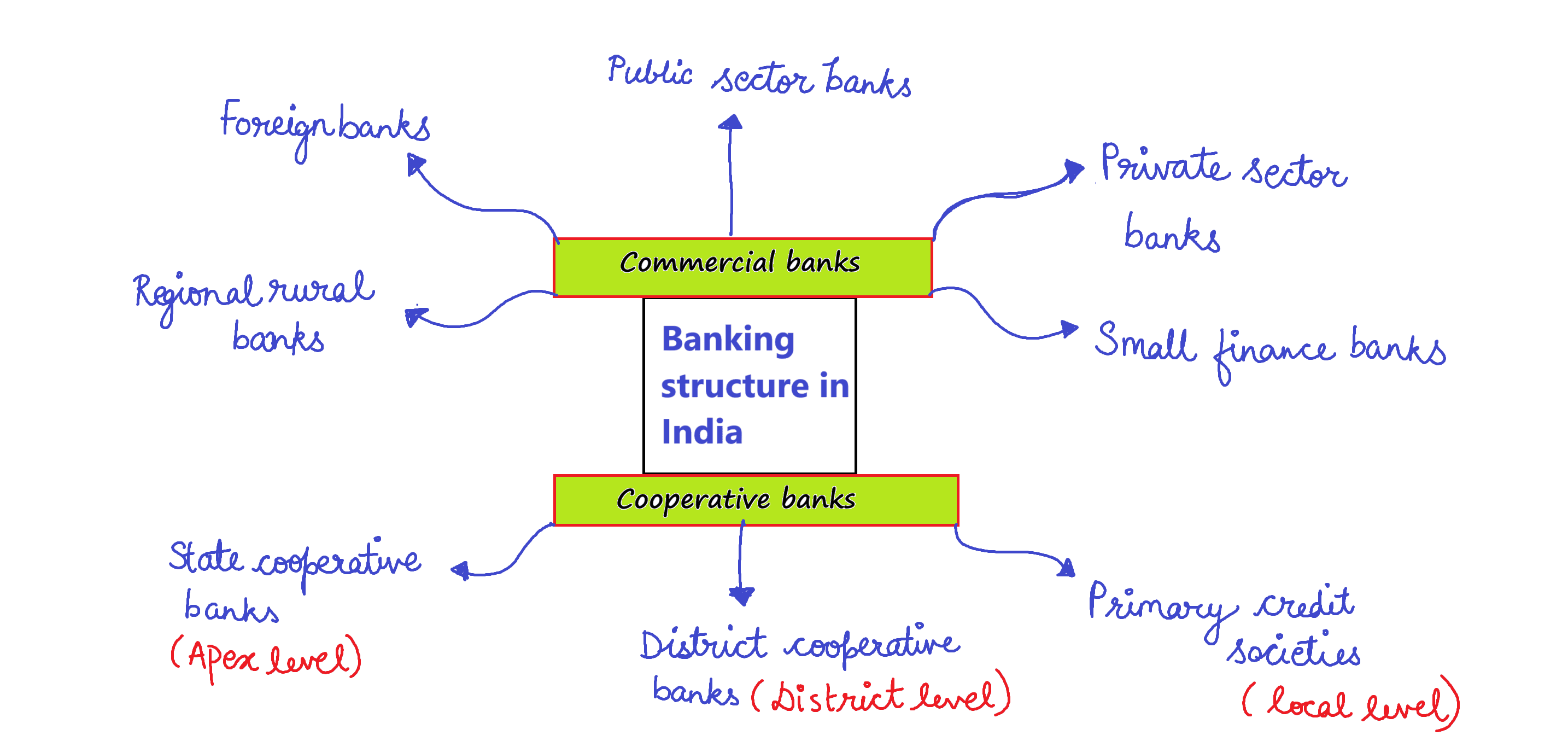

With reference to ‘Urban Cooperative Banks’ in India, consider the following statements:

- They are supervised and regulated by local boards set up by the State Governments.

- They can issue equity shares and preference shares.

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

A. 1 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

QUESTION 11

Easy

Economy

Prelims 2021

The money multiplier in an economy increases with which one of the following?

A. Increase in the Cash Reserve Ratio in the banks.

B. Increase in the Statutory Liquidity Ratio in the banks.

C. Increase in the banking habit of the people.

D. Increase in the population of the country.

QUESTION 12

Medium

Economy

Prelims 2021

Consider the following

- Foreign Currency convertible bonds

- Foriegn Institutional investment with certain conditions

- Global depository receipts

- Non-resident external deposits

Which of the above can be included in Foreign Direct Investments?

A. 1, 2 and 3

B. 2 Only

C. 3 Only

D. 1 and 4

QUESTION 13

Easy

Economy

Prelims 2021

Which one of the following is likely to be the most inflationary in its effects?

A. Repayment of Public debt.

B. Borrowing from the public to finance a budget deficit.

C. Borrowing from the banks to finance a budget deficit.

D. Creation of new money to finance a budget deficit.

QUESTION 14

Easy

Economy

Prelims 2021

India Government Bond Yields are influenced by which of the following?

- Actions of the United States Federal Reserve.

- Actions of the Reserve Bank of India.

- Inflation and short-term interest rates.

Which of the statements given above is/are correct?

A. 1 and 2 only

B. 2 Only

C. 3 Only

D. 1, 2 and 3