You are working as an executive in a nationalised bank for several years. One day one of your close colleagues tells you that her father is suffering from heart disease and needs surgery immediately to survive. She also tells you that she has no insurance and the operation will cost about Rs. 10 lakh. You are also aware of the fact that her husband is no more and that she is from a lower middle class family. You are empathetic about her situation. However, apart from expressing your sympathy, you do not have the resources to fund her. A few weeks later, you ask her about the well-being of her father and she informs you about his successful surgery and that he is recovering. She then confides in you that the bank manager was kind enough to facilitate the release of Rs. 10 lakh from a dormant account of someone to pay for the operation with a promise that it should be confidential and be repaid at the earliest. She has already started paying it back and will continue to do so until it is all returned.

(a) What are the ethical issues involved?

(b) Evaluate the behaviour of the bank manager from an ethical point of view.

(c) How would you react to the situation?

You are working as an executive in a nationalised bank for several years. One day one of your close colleagues tells you that her father is suffering from heart disease and needs surgery immediately to survive. She also tells you that she has no insurance and the operation will cost about Rs. 10 lakh. You are also aware of the fact that her husband is no more and that she is from a lower middle class family. You are empathetic about her situation. However, apart from expressing your sympathy, you do not have the resources to fund her. A few weeks later, you ask her about the well-being of her father and she informs you about his successful surgery and that he is recovering. She then confides in you that the bank manager was kind enough to facilitate the release of Rs. 10 lakh from a dormant account of someone to pay for the operation with a promise that it should be confidential and be repaid at the earliest. She has already started paying it back and will continue to do so until it is all returned.

(a) What are the ethical issues involved?

(b) Evaluate the behaviour of the bank manager from an ethical point of view.

(c) How would you react to the situation?

This case highlights the conflict between empathy and fiduciary duty within a financial institution.

The central ethical dilemma revolves around the bank manager's decision to use funds from a dormant account for a colleague's personal emergency, resembling instances of unauthorized access to customer funds reported in recent banking scandals.

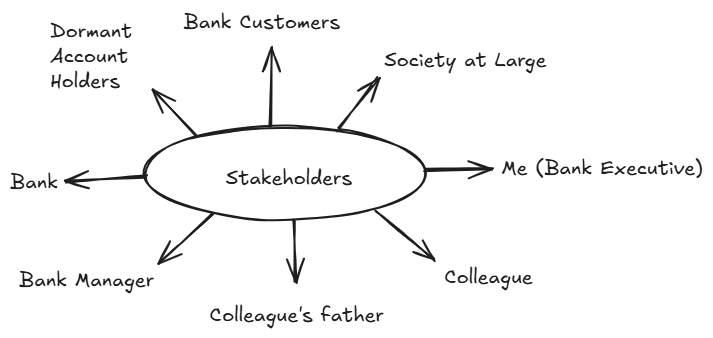

Stakeholder Identification

(a) Ethical Issues Involved:

-

Violation of Fiduciary Duty: The bank manager's action constitutes a severe breach of fiduciary duty towards the bank and its customers, specifically the dormant account holder. This act undermines the fundamental trust placed in banks to safeguard assets.

-

Conflict between Compassion and Professional Ethics: While the manager acted out of compassion, he violated institutional trust and set a dangerous precedent that can be misused.

-

Misappropriation of Funds: Using funds from a dormant account without authorization, regardless of intent, is misappropriation and potentially illegal, violating the rule of law. This action disregards established procedures for accessing and utilizing customer funds.

-

Lack of Transparency and Accountability: The secretive nature of the transaction raises concerns about transparency and accountability within the bank. This secrecy fosters a culture of mistrust and undermines the integrity of the institution.

-

Conflict of Interest: The bank manager's personal relationship with the colleague influenced their decision-making, creating a conflict of interest that compromised their professional judgment. This conflict prioritizes personal relationships over professional obligations.

-

Potential for Systemic Risk: Such unauthorized transactions, if normalized, could create systemic risks for the bank, jeopardizing its financial stability and reputation. This sets a wrong precedent for other employees.

(b) Evaluation of Bank Manager's Behaviour:

-

Deontological Perspective (Immanuel Kant): From a deontological perspective, the bank manager's actions are unethical. The act of misappropriating funds is inherently wrong, regardless of the motivation or outcome. The manager's duty is to uphold the rules and regulations governing banking operations.

-

Utilitarian Perspective (John Stuart Mill): A utilitarian perspective might argue that the manager's actions resulted in a positive outcome (saving a life) and thus maximized overall happiness. However, this perspective fails to account for the potential negative consequences and the violation of rights of customers.

-

Virtue Ethics (Aristotle): The manager's actions demonstrate lack of key virtues such as integrity, honesty, and justice. Their decision was driven by empathy, but it was misapplied and ultimately compromised their character.

-

Justice Approach (John Rawls): The manager's actions violate the principles of fairness and equality. The dormant account holder's rights were disregarded without their knowledge or consent, failing to uphold the veil of ignorance.

-

Intent-Based Evaluation: The manager acted to save a life, showing a high degree of empathy and humaneness. He ensured a repayment mechanism, indicating an attempt at restitution.

(c) Your Reaction to the Situation:

-

Initial Reaction: Acknowledge the emotional gravity of the situation and express empathy for your colleague’s distress and your admiration for her sense of responsibility to repay.

-

Ethical Standpoint:

- As a responsible officer, you cannot ignore the ethical and legal breach.

- The action, if discovered externally (e.g. audit), can harm your colleague, the manager, and the bank.

-

Suggested Course of Action:

-

Encourage your colleague to bring the matter to the attention of senior bank officials or the internal ethics committee voluntarily, explaining the context and intent behind the action.

-

Offer your support as a witness to her honesty, repayment effort, and the circumstances.

-

If she refuses, you may consider reporting the matter confidentially through the appropriate internal channels (like the Vigilance or Ethics Committee).

-

-

Preventive Approach:

-

Propose to the management the creation of an employee emergency fund or corporate social responsibility (CSR) fund to help genuine medical emergencies.

-

This would institutionalize support without ethical compromise.

-

Promoting Ethical Awareness: This situation highlights the need for ongoing ethics training and awareness programs within the bank to reinforce the importance of fiduciary duty, transparency, and accountability.

-

Strengthening Internal Controls: The bank should review and strengthen its internal controls to prevent similar incidents from occurring in the future. This includes stricter access controls for dormant accounts and clear procedures for handling exceptional circumstances.

-

While saving a life is noble, institutional integrity and rule of law cannot be bypassed, especially in the banking sector where trust is paramount. The best course of action is to rectify the breach through official channels while advocating for systemic reforms to support employees in distress ethically.

Answer Length

Model answers may exceed the word limit for better clarity and depth. Use them as a guide, but always frame your final answer within the exam’s prescribed limit.

In just 60 sec

Evaluate your handwritten answer

- Get detailed feedback

- Model Answer after evaluation

Model Answers by Subject

Crack UPSC with your

Personal AI Mentor

An AI-powered ecosystem to learn, practice, and evaluate with discipline