8th Pay Commission in India UPSC Notes: Objectives, Composition, NPS vs UPS

Nov, 2025

•4 min read

Why in the News?

The Union Cabinet approved the 8th Pay Commission on 28 October 2025. Justice Ranjana Prakash Desai was appointed as its Chairperson on November 3, 2025, becoming the first woman to lead a Central Pay Commission. The recommendations are expected to take effect from 1st January 2026, with new salary and pension structures for central government employees and pensioners.

Why Cover This Topic for UPSC?

- Relevant for UPSC Prelims & Current Affairs.

- Relevant for Mains GS Paper III (Government finances, fiscal impact)

- Important for Essay and Interview discussions

What is a Pay Commission?

A Pay Commission is a government body that reviews and recommends changes to the salaries, pensions, and benefits of central government employees. It examines whether government employees are earning enough to live comfortably and suggests fair salary increases based on inflation and economic conditions.

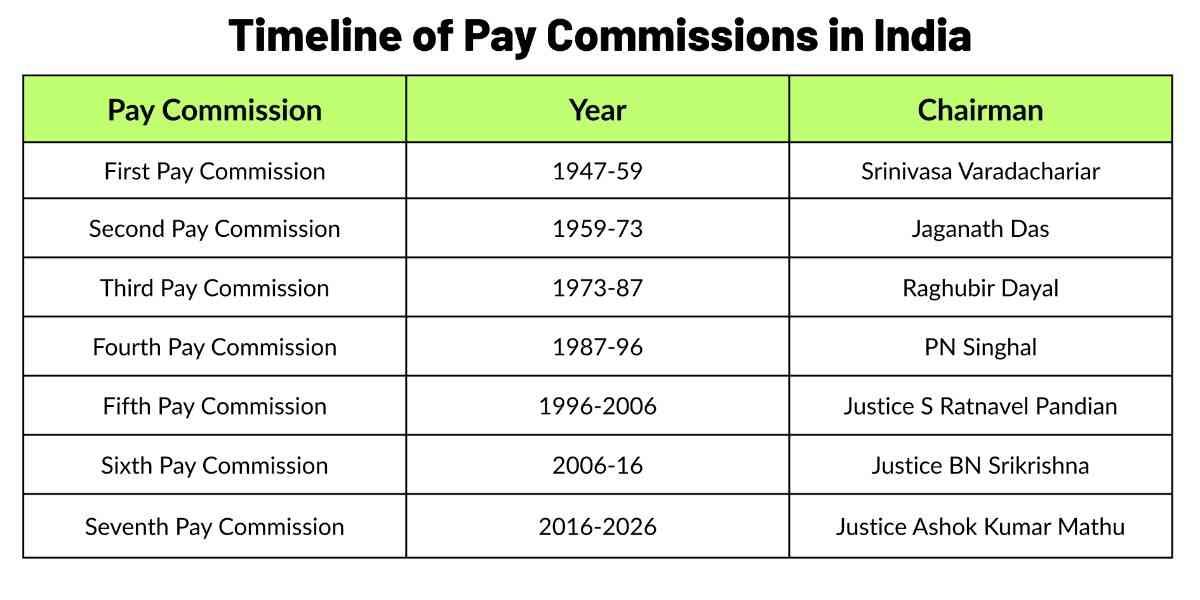

- Established in 1946, under the chairmanship of Shri Srinivasa Varadachariar.

- A Pay Commission is usually constituted every 10 years to keep salaries relevant to the times.

- Seven Pay Commissions have been formed since Independence (1947 to present).

- The latest pay commission (7th) was set up in 2014 and implemented in 2016.

- Pay Commissions are not mandatory to be accepted by the government; the government can choose to accept or reject recommendations.

- The Commission comes under the Department of Expenditure, Ministry of Finance.

Also read: PM SVANidhi Scheme: Empowering Urban Street Vendors

8th Pay Commission Overview

The 8th Pay Commission has been formed to review and revise the pay, allowances, and pensions of central government employees and pensioners from 2026 onward.

| Aspect | Details |

|---|---|

| Establishment Date | October 28, 2025 |

| Chairperson | Justice Ranjana Prakash Desai (First Woman) |

| Implementation Date | January 1, 2026 |

| Expected Salary Hike | 30-34% increase |

| Fitment Factor | 2.28 (may range 1.92-2.86) |

| Expected Pension Hike | Nearly 3x increase in minimum pension |

| Headquarters | New Delhi |

Key Objectives of Pay Commission

The Pay Commission serve a crucial role in keeping India's government salary structure fair and modern. The main objectives are:

- Adjusting salaries to counter rising living costs so employees maintain their purchasing power.

- Making sure government employees earn competitively compared to the private sector.

- Motivating employees by regularly revising remuneration and showing the government values their service.

- Balancing employee welfare with the government's ability to pay without harming development and welfare spending.

- Increasing the purchasing power of government employees boosts consumption and overall economic growth.

- Examining working conditions, promotion policies, retirement benefits, and other service-related matters.

Also read: Securities and Exchange Board of India (SEBI): Powers, Functions, & Recent Reforms

About the 8th Pay Commission

The 8th Pay Commission is structured as a compact three-member team, smaller than some earlier commissions but carefully selected for expertise and experience.

1. Chairperson: Justice Ranjana Prakash Desai

- Retired Supreme Court judge

- First woman to lead a Central Pay Commission.

- Previously headed the Delimitation Commission (2020) and the Uttarakhand Uniform Civil Code Committee (2022).

2. Members:

- Part-time Member: Prof. Pulak Ghosh (IIM Bengaluru)

- Member-Secretary: Pankaj Jain (IAS officer, 1990 batch, currently Ministry of Petroleum secretary)

How the Pay Commission Works

The Pay Commission reviews and recommends changes to the salaries, pensions, and benefits of Central Government employees.

- Recruitment of Experts: Appoints advisors, consultants, and experts based on the need for specialised assistance.

- Independent Operations: Formulates its own procedures and working methods to operate independently and efficiently

- Government Cooperation: Receives mandatory cooperation and information from all government ministries and departments

- Base of Operations: Works from its headquarters in New Delhi with administrative support.

- Time Commitment: 18 months to submit complete recommendations.

- Flexibility: Can submit interim reports on specific matters before the final deadline if required

Also read: E-Governance in India: Meaning, Objectives, Pillars, Models and Major Government Policies

UPSC Prelims MCQ on 8th Pay Commission

QUESTION 1

Easy

Economy

Who is the chairperson of the 8th Central Pay Commission?

Select an option to attempt

8th Pay Commission for Pensioners

Pensioners are retired government employees who now live on pensions (monthly payments from the government). The 8th Pay Commission will significantly improve pension amounts for millions of retirees.

1. Pension Calculation Using Fitment Factor:

- Pension is calculated as 50% of the last basic pay drawn at retirement

- The same fitment factor (2.28) will be applied to the pension.

Example: If a pensioner's basic pension was ₹20,000 under the 7th CPC:

- Revised pension = ₹20,000 × 2.28 = ₹45,600 per month

2. Dearness Relief (DR) for Pensioners:

- Dearness Relief is extra money given to pensioners to protect them from inflation.

- Currently, DR is calculated as a percentage of the basic pension.

- DR will likely be reset to zero when the revised pay structure is implemented.

- After implementation, DR will be calculated afresh on the new pension amount.

3. Family Pension:

- In case of a pensioner's death, family members receive 60% of the pension.

- This will also be calculated on the revised pension amounts.

- The minimum family pension is also expected to increase.

4. Maximum Pension:

- The maximum pension is set at 50% of the highest pay in government.

- This ceiling also applies to family pensions.

NPS vs UPS

India has different pension systems for government employees: the National Pension System (NPS) and the new Unified Pension Scheme (UPS).

| Aspect | NPS | UPS |

|---|---|---|

| Type | Market-linked (risky) | Government-guaranteed (safe) |

| Pension Amount | Variable—depends on market returns | Fixed—50% of last salary |

| Contributions | Employee: 10%; Government: 14% | Employee: 10%; Government: 8.5% |

| Minimum Pension | No minimum guarantee | ₹10,000/month guaranteed |

| Inflation Protection | No automatic; depends on returns | Automatic dearness relief |

| Family Pension | Limited options | 60% of the pension goes to the family |

Note:

- NPS = You take investment risk, higher returns possible, no guarantee

- UPS = Government guarantees fixed pension, safe, predictable income

Major Challenges for the 8th Pay Commission

The 8th Pay Commission faces several tough challenges while preparing recommendations. These include managing money, pension issues, and balancing different employee needs.

- Fiscal Burden: Huge cost to the government for salary hikes and pensions. Must balance with defence, healthcare, and infrastructure spending.

- Pension Coverage: Unclear if all existing pensioners or only new retirees will get revised pensions. Creates confusion among 69 lakh pensioners.

- State Government Impact: States follow central pay decisions. Creates financial pressure on state budgets already struggling with limited money.

- Inflation: 10 years of rising prices may have eroded the real value of proposed salary hikes. Need to ensure an increase matches the actual cost of living.

- UPS Transition: Confusion among employees about choosing between NPS and the new UPS scheme. Smooth transition needed for both systems.

UPSC Mains Practice Question

What is the main purpose of the 8th Central Pay Commission, and who will benefit from its recommendations?

Evaluate Your Answer Now!Way Forward

The 8th Pay Commission marks a turning point in India's approach to compensating government employees and pensioners.

- Performance-Linked Pay: Pay based on actual work performance, not just seniority.

- Digital Audit: Use iGOT Karmayogi to track performance data for fair pay decisions.

- Fiscal Sustainability: Limit salary increases to protect government finances long-term.

- Collaborative Mechanism: Central and state governments coordinate pay decisions together.

Also read: India-Pakistan Relations UPSC Notes: History, Wars, Indus Water Treaty

Unlock your UPSC Success with SuperKalam!

Get instant doubt clearance, customised study plans, unlimited MCQ practice, and fast Mains answer evaluation.

Explore SuperKalam's resources and set yourself on the path to success!