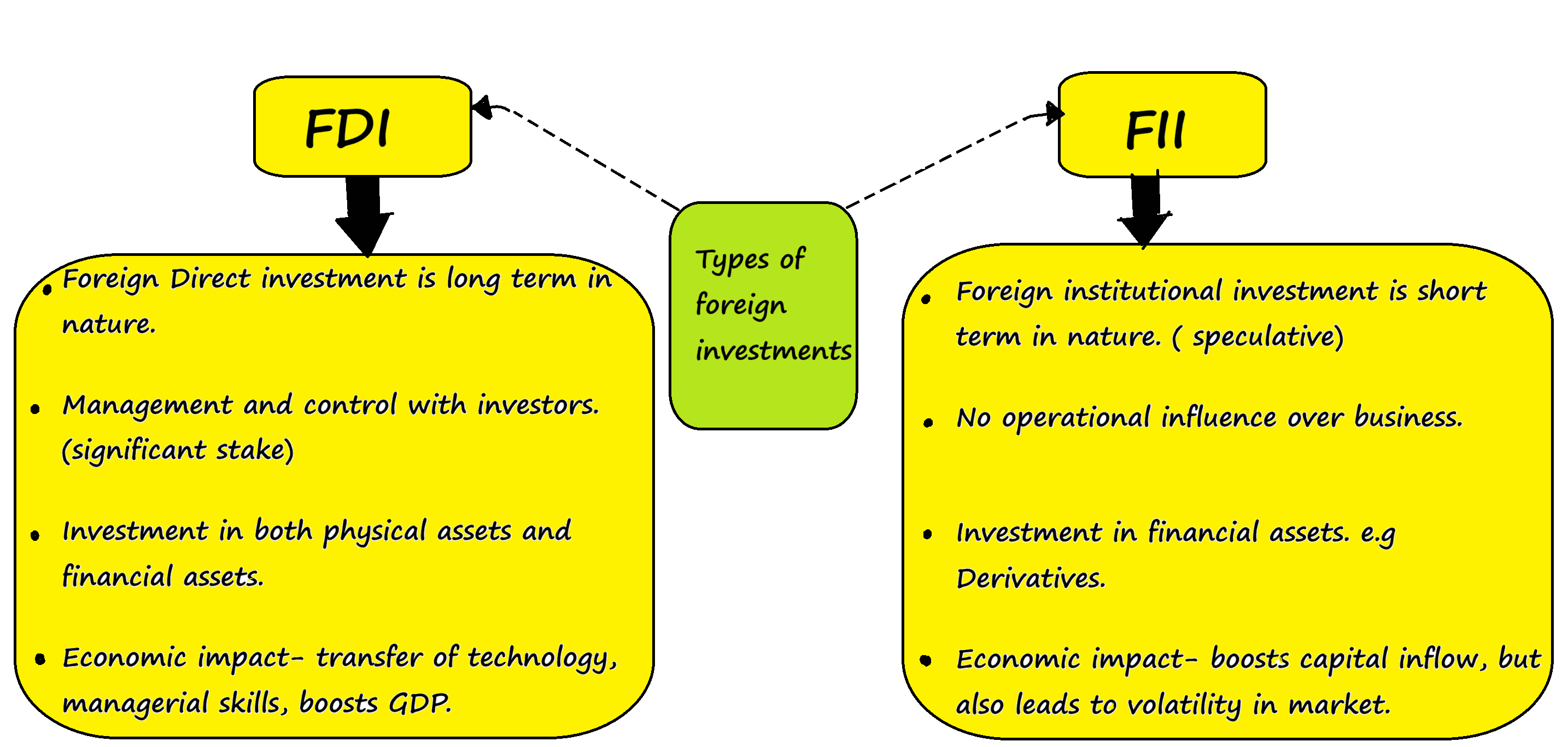

Option A is incorrect. Foreign Direct Investment (FDI) typically involves investment in unlisted companies or companies that involve a direct ownership stake, not just investments through capital instruments in listed companies.

Option B is correct. FDI is considered a non-debt creating capital flow because it involves equity investments that do not require repayment, unlike loans or debt instruments. This type of investment brings in long-term capital and management expertise, which helps in the development of industries in the host country.

Option C is incorrect. FDI does not involve debt-servicing. Unlike loans or bonds, FDI involves ownership stakes, and thus, there is no obligation to pay interest or principal repayments.

Option D is incorrect. The investment in Government securities by foreign institutional investors (FIIs) is considered foreign portfolio investment (FPI), not FDI. FDI focuses on acquiring a substantial ownership stake in a company, whereas FPI involves short-term investments in financial assets.

Types of Foreign Investments

Hence, option B is the correct answer.