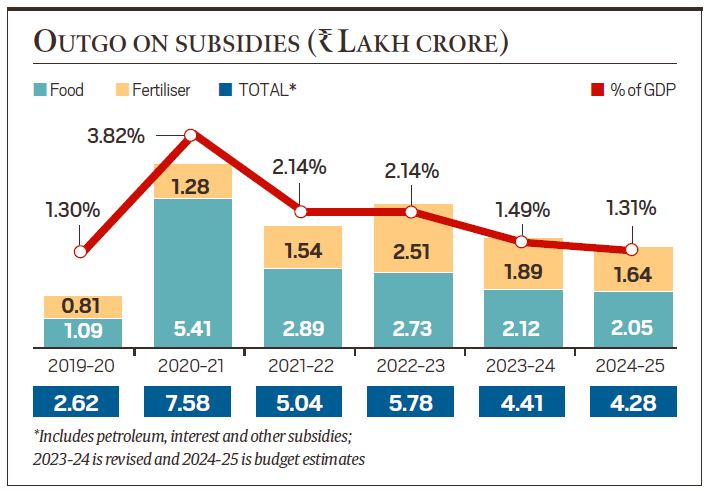

Rationalization of Subsidies

Feb, 2025

•10 min read

Why in News?

India’s subsidy structure has undergone significant reforms, including the deregulation of fuel prices, streamlined LPG subsidies, and enhanced technology-based delivery systems. However, inefficiencies in food subsidies under Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) and rising fertilizer costs highlight the pressing need for rationalizing subsidies to enhance fiscal efficiency and ensure equitable resource distribution.

Introduction

Subsidies in India play a pivotal role in fostering inclusive growth, improving welfare, and addressing socio-economic disparities. They are delivered either through direct transfers or indirect mechanisms, ensuring essential goods and services are accessible to the underprivileged while promoting developmental goals.

:max_bytes(150000):strip_icc()/Subsidy-resized-3e847b1457174be0aaeb0760e42ca2e8.jpg)

However, the current subsidy framework often imposes a significant fiscal burden. This calls for reforms aimed at rationalizing subsidies to improve targeting, enhance efficiency, and align with the goals of fiscal discipline under fiscal policy in India aims to strengthen.

Key Types of Subsidies & their Role

Direct Subsidies

- These involve financial transfers directly to beneficiaries.

- Example: PM-KISAN Samman Nidhi provides direct income support to farmers.

Indirect Subsidies

- Support through tax exemptions or reduced duties.

- Example: Section 80C tax exemptions for investments in housing or insurance.

Input-Based Subsidies

- Reduce the cost of critical inputs like fertilizers and seeds.

- Example: The Nutrient-Based Subsidy (NBS) for fertilizers.

Consumption-Based Subsidies

- Ensure affordability of essential goods.

- Example: Subsidized grains under NFSA or rail concessions for senior citizens.

Production-Linked Subsidies

- Encourage industrial output and sectoral competitiveness.

- Example: The Production Linked Incentive (PLI) Scheme for manufacturing.

Export Subsidies

- Enhance global competitiveness for Indian products.

- Example: The RoDTEP (Remission of Duties and Taxes on Export Products) scheme.

Climate and Environmental Subsidies

- Promote eco-friendly initiatives to combat climate change.

- Example: Subsidies under FAME-II for electric vehicles.

Regional Subsidies

- Foster equitable growth in backward areas.

- Example: North East Industrial and Investment Promotion Policy.

Benefits of Subsidies in Promoting Development

- Ensuring Food Security: Subsidized food grains under PMGKAY benefited 810 million people during the COVID-19 pandemic. The food subsidy allocation for FY25 stands at ₹2.25 lakh crore, emphasizing the importance of targeted subsidies in tackling hunger and poverty.

- Supporting Farmers: Rising fertilizer costs led to an increased subsidy allocation. Special subsidies like ₹3,500/tonne for DAP fertilizers are critical for shielding farmers from global price volatility.

- Promoting Clean Energy: Schemes like PM-KUSUM subsidize solar pumps, helping reduce diesel dependency and carbon emissions.

- Affordable Healthcare: Ayushman Bharat provides ₹5,00,000 in annual health coverage to over 50 crore beneficiaries, reducing out-of-pocket expenses for low-income families.

- Spurring Industrial Growth: The PLI scheme aims to create 60 lakh jobs and boost India’s manufacturing exports, demonstrating the potential of production-linked subsidies.

- Mitigating Climate Change: Under FAME-II, 1.67 million electric vehicles were sold in FY24, significantly reducing CO₂ emissions and fostering green mobility.

Challenges Associated with Subsidies

- Fiscal Strain: India’s subsidy expenditure for FY25 is projected at ₹4.1 lakh crore. Such a large outlay hampers public investments in critical sectors like health and education, underscoring the need for fiscal discipline.

- Targeting Inefficiencies: Leakages in food subsidy systems result in wastage, with nearly 40% of subsidized grains not reaching intended beneficiaries. Similarly, LPG subsidies under PMUY face challenges in delivery and adoption.

- Resource Overuse: Free electricity and fertilizer subsidies contribute to groundwater depletion and soil degradation, endangering long-term agricultural sustainability.

- Market Distortions: Over-reliance on subsidies discourages private investments and innovation, particularly in sectors like agriculture and renewable energy.

- Global Trade Issues: India has faced criticism at the WTO for breaching trade subsidy norms, impacting its global trade relations.

- Populism: Political misuse of subsidies as electoral tools often prioritizes short-term gains over long-term India’s fiscal policy objectives.

Way Forward: Rationalizing Subsidies

Reforms aimed at rationalizing subsidies are essential for addressing inefficiencies while ensuring fiscal sustainability. Key recommendations include:

- Comprehensive DBT Implementation: Extend Direct Benefit Transfers (DBT) to include fertilizer subsidies for better targeting and transparency. Integrate Aadhaar-linked systems to prevent fraud and duplication.

- Dynamic Targeting: Regularly update beneficiary databases using advanced data analytics and SECC (Socio-Economic Caste Census) data to ensure accurate targeting.

- Promoting Sustainable Alternatives: Encourage the adoption of nano urea, organic fertilizers, and renewable energy solutions to reduce dependency on subsidies.

- Technology Integration: Utilize GIS, blockchain, and AI tools to monitor subsidy delivery, track utilization, and prevent leakages.

- Linking Subsidies to Sustainable Practices: Tie agricultural subsidies to initiatives like Soil Health Cards to promote scientific and resource-efficient farming practices.

- Graduated Exit Plans: Implement phased withdrawal strategies for subsidies as beneficiaries achieve self-sufficiency, minimizing dependency.

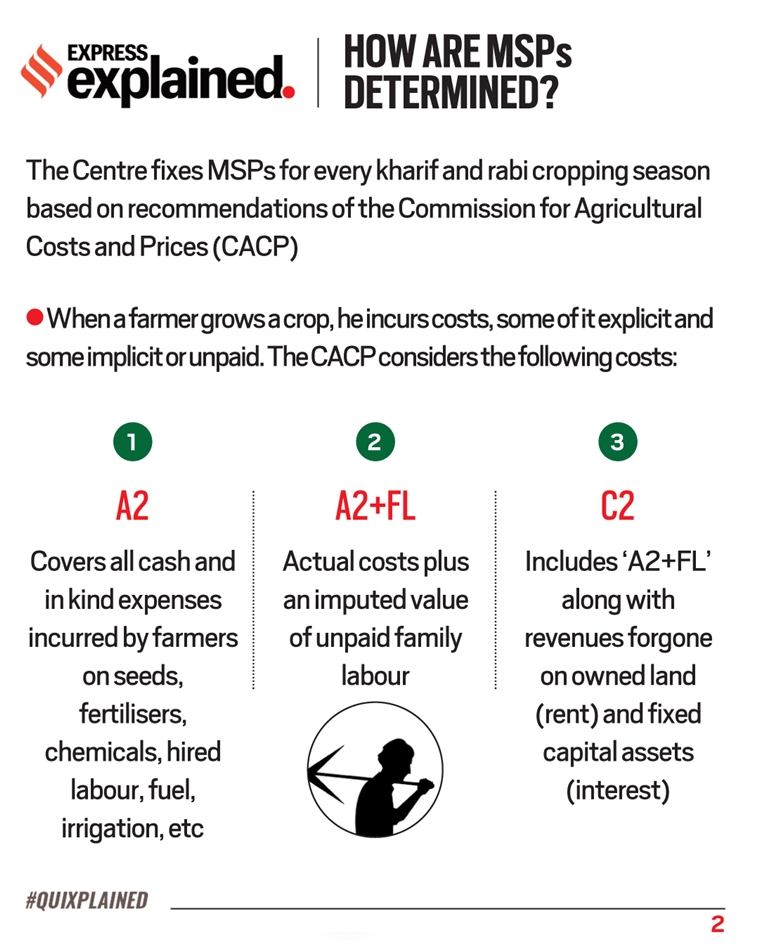

- Crop Diversification: Redirect MSP-linked subsidies towards pulses and oilseeds to conserve water and soil health while reducing over-reliance on water-intensive crops like rice and sugarcane.

Conclusion

India’s subsidy framework has been instrumental in promoting welfare and development, but its sustainability is increasingly questioned due to fiscal pressures and inefficiencies. The focus must now shift to rationalizing subsidies, aligning them with developmental goals while maintaining fiscal discipline. Reforms through DBT, technology integration, and promoting sustainable practices will ensure that subsidies remain a tool for inclusive growth without compromising the broader objectives of fiscal policy in India.

FAQs on Subsidies

1. What is the difference between subsidies & freebies?

- Subsidies: Financial support provided by the government to lower the cost of essential goods/services (e.g., food, fertilizers, LPG) to promote welfare and economic growth.

- Freebies: Non-essential, populist giveaways (e.g., free electricity, loan waivers) often used for political gains without long-term economic benefits.

2. What are irrational subsidies?

Irrational subsidies are those that distort markets, burden fiscal resources, and encourage inefficiency. Examples include excessive fertilizer subsidies leading to soil degradation or free electricity causing groundwater depletion.

3. What is MSP?

Minimum Support Price (MSP) is a government-set price at which it purchases crops from farmers to ensure fair income and price stability. It is announced for 23 crops and acts as a price cushion during market fluctuations.

Mains PYQs

- What are the different types of agriculture subsidies given to farmers at the national and

state levels? Critically analyze the agriculture subsidy regime with the reference to the

distortions created by it (2013/10M) - In what way could replacement of price subsidy with Direct Benefit Transfer (DBT)

change the scenario of subsidies in India? Discuss (2015/12.5M) - How do subsidies affect the cropping pattern, crop diversity and economy of farmers?

What is the significance of crop insurance, minimum support price and food processing for

small and marginal farmers? (2017/15M)

Prelims PYQs

1. Which of the following factors/policies were affecting the price of rice in India in the recent past? (2020)

- Minimum Support Price

- Government's trading

- Government's stockpiling

- Consumer subsidies

Select the correct answer using the code given below:

A 1, 2 and 4 only

B 1, 3 and 4 only

C 2 and 3 only

D 1, 2, 3 and 4

2. There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit? (2015)

- Reducing revenue expenditure

- Introducing new welfare schemes

- Rationalizing subsidies

- Reducing import duty

Select the correct answer using the code given below.

A 1 only

B 2 and 3 only

C 1 and 3 only

D 1, 2, 3 and 4